The Social Security Administration (SSA) has implemented significant changes to its overpayment recovery process, offering a much-needed reprieve for beneficiaries who receive accidental overpayments.

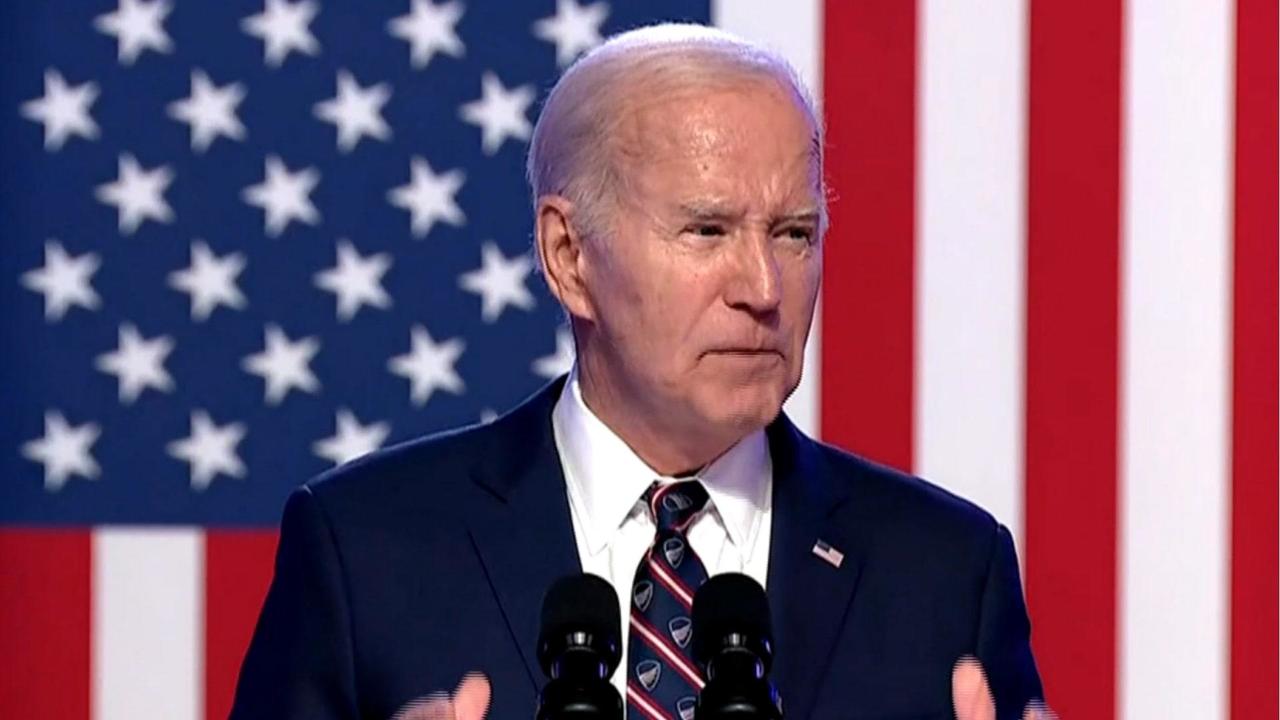

This reform, spearheaded by the Biden administration, aims to lessen the financial burden on retirees, survivors, and individuals with disabilities who might have faced a substantial reduction in their monthly benefits due to overpayments.

Understanding Social Security Overpayments

A Social Security overpayment occurs when a beneficiary receives more money than they are entitled to for a specific month. This can happen for various reasons, such as:

- Changes in Income: If a beneficiary’s income increases beyond the permissible limit, it might trigger an overpayment.

- Eligibility Changes: Certain life events, like returning to work or receiving additional income from pensions, can affect eligibility and lead to overpayments.

- Administrative Errors: Occasionally, mistakes during processing can result in overpayments.

Previously, the SSA recovered overpayments by withholding a significant portion, often 100%, of a beneficiary’s monthly benefit until the overpayment was fully repaid. This practice placed a significant financial strain on beneficiaries, potentially forcing them to cut back on essential expenses.

The 2024 Overpayment Recovery Reform

The Biden administration’s reform introduces a more manageable approach to overpayment recovery. Here are the key changes:

- Reduced Withholding Rate: The default withholding rate for overpayments has been reduced from 100% to 10% of the monthly benefit, or $10, whichever is greater. This significantly lessens the immediate financial hardship on beneficiaries.

- Expanded Waiver Options: Beneficiaries can now request a waiver of repayment if they can demonstrate financial hardship. Previously, the burden of proof rested on the beneficiary to show they were not at fault for the overpayment. The SSA will now assume this responsibility.

- Extended Repayment Period: Beneficiaries seeking a lower withholding rate can have their repayment period extended to 60 months, compared to the previous 36-month limit. This allows for a more manageable repayment schedule.

- Appeal Rights Remain: Beneficiaries who believe they were not overpaid or that the amount is incorrect can still file an appeal within 60 days of receiving the notification. Their benefits will continue uninterrupted during the appeal process.

These changes represent a substantial shift in how the SSA handles overpayments, prioritizing fairness and minimizing financial hardship for beneficiaries.

What to Do if You Receive a Social Security Overpayment Notice in 2024

If you receive a Social Security Overpayment Notice in 2024, here’s what you should do:

- Review the Notice Carefully: The notice will detail the reason for the overpayment, the amount owed, repayment options, and your appeal and waiver rights.

- Contact the SSA: If you have any questions or believe the information is inaccurate, contact the SSA at 1-800-772-1213 (TTY: 1-800-325-0778) to discuss your options.

- Consider a Waiver: If repaying the overpayment would cause financial hardship, explore the waiver process by contacting the SSA. They will assess your situation and determine eligibility.

- Appeal if Necessary: If you believe you were not overpaid or the amount is incorrect, file an appeal within 60 days of receiving the notice.

The SSA website also provides valuable information on overpayments, including a step-by-step guide on the repayment process and details on requesting a waiver https://www.ssa.gov/manage-benefits/repay-overpaid-benefits.

Impact of the 2024 Reform

The 2024 reform is expected to have a significant positive impact on Social Security beneficiaries. Here’s a breakdown of the potential benefits:

- Reduced Financial Hardship: The lower withholding rate will prevent beneficiaries from experiencing a drastic reduction in their monthly income, allowing them to maintain their standard of living.

- Fairer Repayment Process: The shift in the burden of proof for waivers and the extended repayment period make the process more equitable for beneficiaries.

- Improved Communication: The reform emphasizes clear communication with beneficiaries regarding overpayments, repayment options, and their rights.

While the reform addresses immediate concerns, challenges remain. Here are some ongoing issues:

- Uncollected Overpayments: Despite recovery efforts, the SSA still faces a significant backlog of uncollected overpayments. Further improvements in processing efficiency may be needed.

- Public Awareness: Many beneficiaries might not be aware of the changes or their rights regarding overpayments. Increased outreach and education efforts are crucial.

The 2024 Social Security Overpayment reform represents a positive step toward a more compassionate and efficient system for handling overpayments.