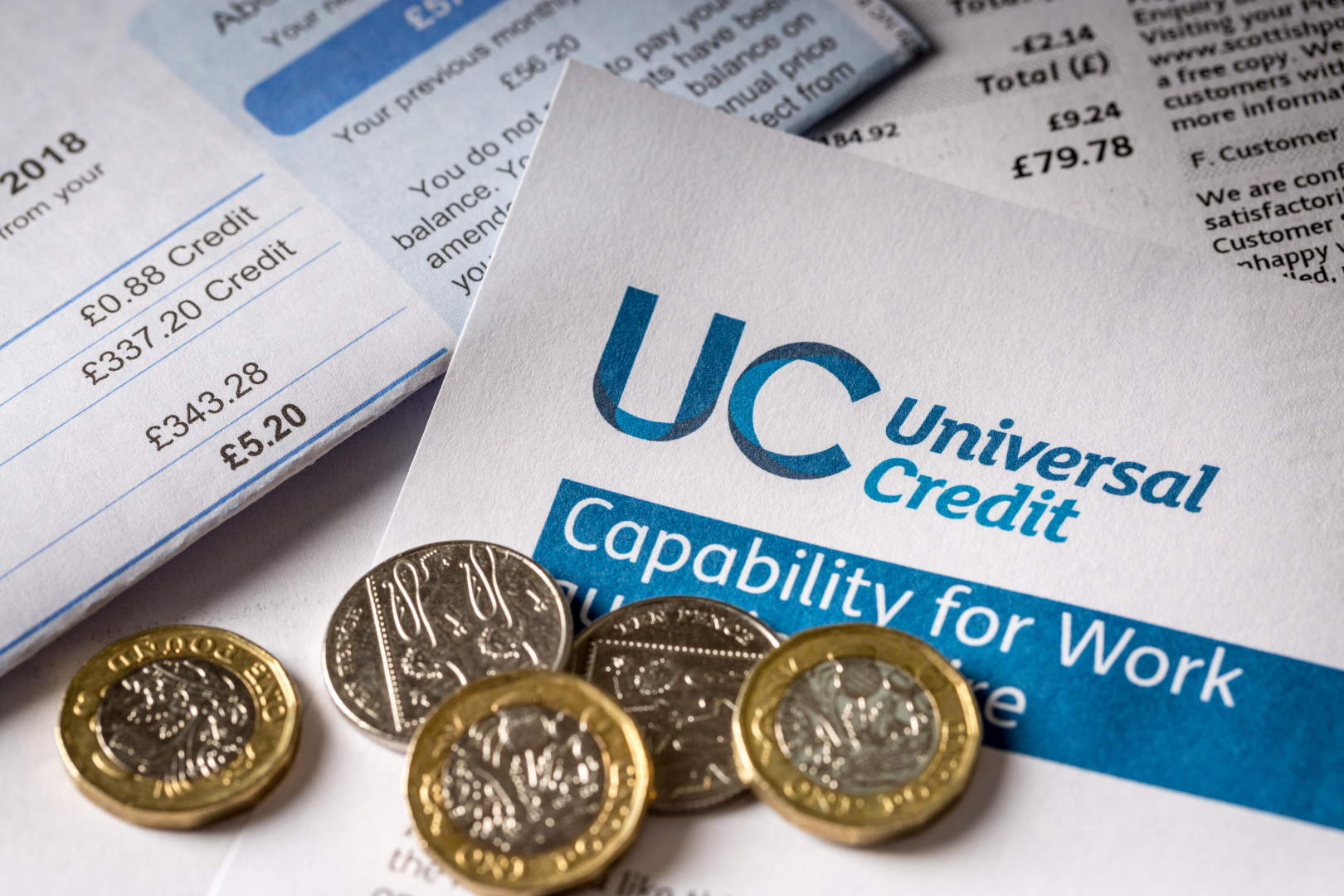

Universal Credit (UC) is a vital financial support system for millions of low-income individuals, families, and those with disabilities in the United Kingdom. With the rising cost of living significantly impacting household budgets, many are wondering what changes to expect for Universal Credit in 2024. This article will explore the current state of UC, potential increases, and how the program helps manage living expenses.

What is Universal Credit?

UC is a monthly payment administered by the Department for Work and Pensions (DWP) that helps eligible individuals and families cover essential living costs.

It replaces several previous benefits, including income support, Jobseeker’s Allowance (JSA), Employment and Support Allowance (ESA), Child Tax Credit, Working Tax Credit, and Housing Benefit. By consolidating these benefits into a single payment, UC aims to simplify the welfare system and make claiming benefits easier.

Eligibility for Universal Credit

To qualify for Universal Credit, you must generally:

- Be aged 18 or above and under the State Pension age.

- Reside in the United Kingdom.

- Have limited income or be out of work.

- In specific circumstances, individuals aged 16 or 17 may also be eligible.

- Have savings, investments, and money totaling less than £16,000.

The amount of UC you receive depends on your individual circumstances, including your age, living situation, and whether you have children.

Universal Credit Standard Allowances

Standard allowances are fixed amounts within UC that contribute towards your everyday living expenses. The amount you receive depends on your marital status, age, and whether you have children. Here’s a breakdown of the standard allowances for 2023/24 (increased by 10.1% compared to the previous year):

- Single claimant under 25 years old: £292.11 per month

- Single claimant 25 years old or over: £368.74 per month

- Couple (joint claimants) under 25 years old: £458.51 per month

- Couple (joint claimants) 25 years old or over £578.82 per month

These are the base rates for UC payments. Additional benefits may be added based on your specific needs, such as housing costs, childcare costs, caring responsibilities, or a disability.

Universal Credit Changes in 2024

The UC system is designed to adjust to inflation to ensure recipients maintain a similar level of support. In April 2023, UC rates rose by 10.1% in response to the rising cost of living.

For 2024, the DWP will again review UC rates based on the Consumer Price Index (CPI) inflation figure. It is expected that UC will see an increase of approximately 6.7% in line with the current inflation rate. This means the standard allowances mentioned above will likely go up by a similar percentage in April 2024.

While the exact increase won’t be confirmed until the official announcement by the DWP, some beneficiaries might see an additional £38-£40 per month added to their standard allowance if the 6.7% increase holds true. This would bring the potential new standard allowances for couples over 25 to around £617 per month.

Important Note: It’s crucial to understand that the £578.82 figure mentioned in some headlines is the current standard allowance for couples aged 25 or over, not an additional payment.

How Will the Changes Affect You?

The impact of the UC changes in 2024 will vary depending on your individual circumstances. If you are a single claimant or a couple with no children, the increase will likely be in the range of £20-£25 per month. However, families with children may see a more significant rise due to additional child elements within their UC award.

The DWP will notify all UC recipients of any changes to their payments well in advance. You can also check your online UC account or contact the DWP for more information about your specific award.

Additional Support Available Alongside Universal Credit

While UC helps cover essential living costs, it may not always be enough. Here are some additional resources available to UC claimants:

- Council Tax Reduction: This scheme helps eligible individuals and families reduce their council tax bills.

- Discretionary Housing Payment: This top-up payment may be available to help with rent costs if UC doesn’t cover the full amount.

- Healthy Start Scheme: This scheme provides vouchers for milk, fresh fruit and vegetables, and vitamins for pregnant women and young children.

- Free School Meals: Children from low-income families may be eligible for free school meals.